SEA CHANGE: Aug. 1 deadline makes major changes to loan closings

Published 3:29 pm Thursday, May 28, 2015

As of Aug. 1, federal law may put a crimp in the works for buying or selling a property, with a broad array of changes that will affect every entity involved in the process: from lenders and attorneys, right on down to real estate agents, buyers and sellers.

“It is a kind of a sea change in the way that loan closings are happening,” said Keith Mason, a local attorney. “We have been trying to learn about it and get ready for it for the past year.”

The change in law came in response to the financial crisis in 2008 — Congress decided to consolidate authority over of loan closings, creating an entity called the Consumer Financial Protection Bureau (CFPB), which was given sole authority in regulating banks and the closings of loans.

“They are the new sheriff in town that controls everything,” Mason said.

In theory, CFPB is streamlining the loan process. Previously, the completion of two documents before closing and another two at closing were required. Those required prior to closing were a preliminary Truth In Lending disclosure (TIL), which determines preliminary numbers regarding the total amount of principal and interest paid throughout a loan term, and a Good Faith Estimate (GFE), a ballpark estimate of all fees associated with the closing, which range from bank fees, insurance company fees and recording fees at the courthouse, among many others, potentially.

At closing, two final documents were required: a final TIL, a more refined version of the preliminary TIL because it’s based on real numbers; and what was called a HUD (Housing and Urban Development) 1 settlement statement, which details how all the money involved is going to play out—basically, how much money a buyer has to bring to the closing table.

“All that was too confusing, so they wanted to change that. So the CFPB decided they were going to consolidate down to two,” Mason said.

As of Aug. 1, preliminary TILs and GFEs will be consolidated into one document call a Loan Disclosure Form, and the final TIL and HUD 1 settlement statement will be combined into a Closing Disclosure.

“It’s a completely different format; the numbers are different places. It’s calculated differently and it’s just going to take a lot of practice,” Mason said. “Is it making the whole business any clearer for John Q. Public to understand what he’s doing? I don’t know. I think that remains to be seen.”

Practice will be necessary, because there a few major changes besides the forms and information contained within, ones that have the potential to cause some problems at closing, which has had lenders, attorneys and real estate agents scrambling to decipher the law.

First, the Closing Disclosure must be finalized three days before closing.

“In a real estate transaction, things seem to go slowly and then everything seems to happen all at once, even though, from a realtor’s perspective, we’ve been working all along,” said Maria Wilson, part owner of Coldwell Banker Coastal Rivers Realty in Washington. “Now, instead of the closing statement being able to be changed at the closing table, any substantial financial change to the closing statement resets the clock three days.”

And example would be the HVAC system on the property in negotiation suddenly stops working the day before all parties sit down to the closing table. Whether the current owner promises to fix it before moving out or the buyer decides to fix it in exchange for a reduction in price, that change — any major change — to the documentation would mean starting over the required three-day deadline for paperwork.

“As realtors, we try to coordinate those changes, anticipate them so we don’t have this problem and that’s what we’re trained to do. But it will be a big change for everyone. It’s definitely going to take longer to get a loan closed,” Wilson said.

For Mason and other local attorneys who handle real estate closings, the new law will bring about changes to how they do business. North Carolina is different than other states in that attorneys, rather than title companies, primarily do closings. Now a company called the American Land Title Association will essentially be policing the process, creating a list of “best practices” by which all closing entities must abide. The “best practices” include regulations about licensing, escrow trust accounts, privacy and information security, liability insurance and more.

“What it really comes down to is putting together an office manual,” Mason said.

But that’s not all it entails: ALTA’s “best practices” also call for attorneys who handle closings to comply with other standards like encrypted emails to protect consumer confidentiality, creating secured areas where that information is kept and paying for inspections — estimates at $2,000 — so an attorney can be certified to do closings.

“It’s a tremendous outlay of capital. The net result is I think you can expect prices to go up for closings. The going rate here is $600 to $750. I would expect that’s probably going to go up to maybe $1,000. Everybody’s going to have to increase their prices to cover their overhead,” Mason said.

While higher attorneys’ fees could be an additional cost at closing, they won’t likely be the only inconvenience to buyers and sellers: if any change happens within that three-day window, it could set off a domino effect, where a home seller has to postpone closing on another home, or a buyer could end up stuck with a moving truck full of furniture with no place to put it for a couple of days. Those situations are what real estate agents are hoping to avoid by being as prepared for the change as they can be.

“I think people need a realtor now more than ever. It is a complicated puzzle as it is, and this adds more pieces and the sequences of how things need to be done. … We’ll learn when problems crop up. I don’t think anyone knows the repercussions,” Wilson said. “The most difficulty will be with the buyers and sellers — I mean, we go home at night. Buyers and sellers can’t.

“The positive part of the story is that we, as realtors, are working with the lawyers and the banks to work out a strategy so this affects the public as little as possible.”

SUGGESTED HEADLINE: SEA CHANGE

SUBHEAD: Aug. 1 deadline makes major changes to loan closings

By VAIL STEWART RUMLEY

Washington Daily News

CUTLINES:

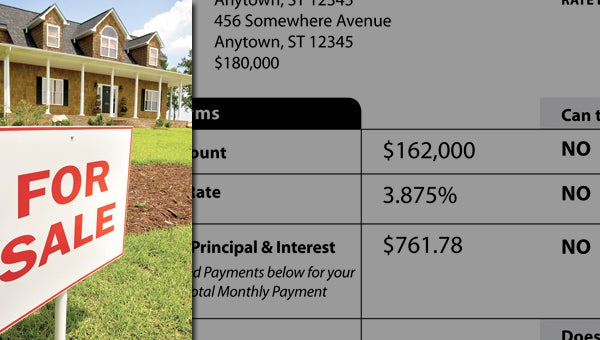

FOR SALE: Change in federal law has the potential to make buying and selling property a longer and, perhaps, inconvenient process.

CH-CH-CHANGES: A look at one of Consumer Financial Protection Bureau’s new documents that will replace two previously required in the loan process. The documents can be found at www.consumerfinance.gov.

As of Aug. 1, federal law may put a crimp in the works for buying or selling a property, with a broad array of changes that will affect every entity involved in the process: from lenders and attorneys, right on down to real estate agents, buyers and sellers.

“It is a kind of a sea change in the way that loan closings are happening,” said Keith Mason, a local attorney. “We have been trying to learn about it and get ready for it for the past year.”

The change in law came in response to the financial crisis in 2008 — Congress decided to consolidate authority over of loan closings, creating an entity called the Consumer Financial Protection Bureau (CFPB), which was given sole authority in regulating banks and the closings of loans.

“They are the new sheriff in town that controls everything,” Mason said.

In theory, CFPB is streamlining the loan process. Previously, the completion of two documents before closing and another two at closing were required. Those required prior to closing were a preliminary Truth In Lending disclosure (TIL), which determines preliminary numbers regarding the total amount of principal and interest paid throughout a loan term, and a Good Faith Estimate (GFE), a ballpark estimate of all fees associated with the closing, which range from bank fees, insurance company fees and recording fees at the courthouse, among many others, potentially.

At closing, two final documents were required: a final TIL, a more refined version of the preliminary TIL because it’s based on real numbers; and what was called a HUD (Housing and Urban Development) 1 settlement statement, which details how all the money involved is going to play out—basically, how much money a buyer has to bring to the closing table.

“All that was too confusing, so they wanted to change that. So the CFPB decided they were going to consolidate down to two,” Mason said.

As of Aug. 1, preliminary TILs and GFEs will be consolidated into one document call a Loan Disclosure Form, and the final TIL and HUD 1 settlement statement will be combined into a Closing Disclosure.

“It’s a completely different format; the numbers are different places. It’s calculated differently and it’s just going to take a lot of practice,” Mason said. “Is it making the whole business any clearer for John Q. Public to understand what he’s doing? I don’t know. I think that remains to be seen.”

Practice will be necessary, because there a few major changes besides the forms and information contained within, ones that have the potential to cause some problems at closing, which has had lenders, attorneys and real estate agents scrambling to decipher the law.

First, the Closing Disclosure must be finalized three days before closing.

“In a real estate transaction, things seem to go slowly and then everything seems to happen all at once, even though, from a realtor’s perspective, we’ve been working all along,” said Maria Wilson, part owner of Coldwell Banker Coastal Rivers Realty in Washington. “Now, instead of the closing statement being able to be changed at the closing table, any substantial financial change to the closing statement resets the clock three days.”

And example would be the HVAC system on the property in negotiation suddenly stops working the day before all parties sit down to the closing table. Whether the current owner promises to fix it before moving out or the buyer decides to fix it in exchange for a reduction in price, that change — any major change — to the documentation would mean starting the required three-day deadline for paperwork over.

“As realtors, we try to coordinate those changes, anticipate them so we don’t have this problem and that’s what we’re trained to do. But it will be a big change for everyone. It’s definitely going to take longer to get a loan closed,” Wilson said.

For Mason and other local attorneys who handle real estate closings, the new law will bring about changes to how they do business. North Carolina is different than other states in that attorneys, rather than title companies, primarily do closings. Now a company called the American Land Title Association will essentially be policing the process, creating a list of “best practices” by which all closing entities must abide. The “best practices” include regulations about licensing, escrow trust accounts, privacy and information security, liability insurance and more.

“What it really comes down to is putting together an office manual,” Mason said.

But that’s not all it entails: ALTA’s “best practices” also call for attorneys who handle closings to comply with other standards like encrypted emails to protect consumer confidentiality, creating secured areas where that information is kept and paying for inspections — estimates at $2,000 — so an attorney can be certified to do closings.

“It’s a tremendous outlay of capital. The net result is I think you can expect prices to go up for closings. The going rate here is $600 to $750. I would expect that’s probably going to go up to maybe $1,000. Everybody’s going to have to increase their prices to cover their overhead,” Mason said.

While higher attorneys’ fees could be an additional cost at closing, they won’t likely be the only inconvenience to buyers and sellers: if any change happens within that three-day window, it could set off a domino effect, where a home seller has to postpone closing on another home, or a buyer could end up stuck with a moving truck full of furniture with no place to put it for a couple of days. Those situations are what real estate agents are hoping to avoid by being as prepared for the change as they can be.

“I think people need a realtor now more than ever. It is a complicated puzzle as it is, and this adds more pieces and the sequences of how things need to be done. … We’ll learn when problems crop up. I don’t think anyone knows the repercussions,” Wilson said. “The most difficulty will be with the buyers and sellers — I mean, we go home at night. Buyers and sellers can’t.

“The positive part of the story is that we, as realtors, are working with the lawyers and the banks to work out a strategy so this affects the public as little as possible.”