County audit returned with no findings

Published 8:06 pm Thursday, January 10, 2019

Beaufort County finances received a clean bill of health from Jeff Best CPAs.

The 2017-18 audit represented the second year running that auditors have found no issues with the county finances, a vast improvement over the 2014-15 audit that came back with 13 findings and the following year’s audit that found three holdovers from the previous year’s findings.

“We continue always looking at processes and trying to make them better, but we feel like the basics are there to continue to not have findings in the future,” said county Manager Brian Alligood. “There were no material issues there. Our staff works hard to make sure things are done right.”

Beaufort County Chief Finance Officer Anita Radcliffe and CPA Jeff Best presented the audit to the Beaufort County Board of Commissioners at Monday night’s regular board meeting.

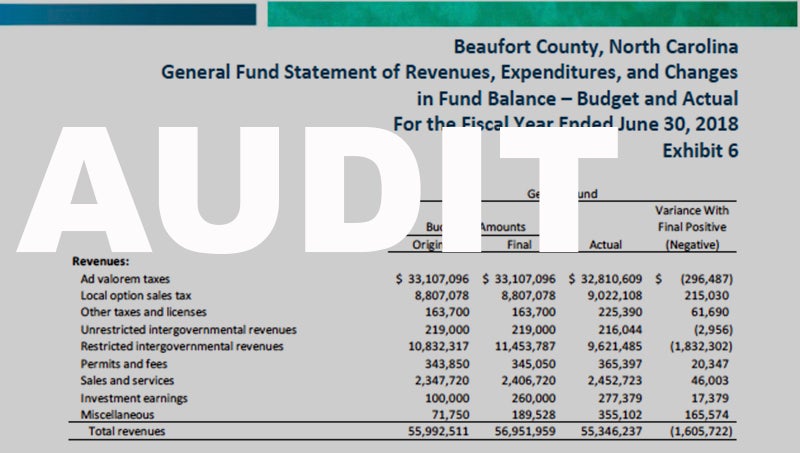

Radcliffe ran through the numbers: total revenue budgeted was $1,605,722 less than what actually came in 2017-18, though this was mostly attributed to a change in protocol in which the county is no longer responsible for processing some DSS funds. Ad valorem taxes came in under expectations, as well: actual taxes collected $32,810,609; $33,107,096 was budgeted.

Sales taxes came in higher than expected: $9,022,108 versus $8,807,078 expected.

“That is solely tied to the economy,” Radcliffe told commissioners.

Overall, the county spent $4,069,117 less than was budgeted in 2017-18: expenditures were budgeted at $59,072,062, yet the county spent $55,002,945. The end result is that the county revenues outweighed expenditures by $2,463,395.

Radcliffe broke down the main sources of revenue and expenditures. Ad valorem (property) taxes are 59.3 percent, sales tax, 16.3 percent and restricted intergovernmental funds at 17.4 percent — together they represent 94 percent of Beaufort County’s revenues. In the opposite direction, Beaufort County spends 33 percent of its budget on education, 26.47 percent on human services and 21.55 percent on public safety.

Auditors recommended two improvements to the county finances, both having to do with Beaufort County Department of Social Services processes. DSS had been applying for reimbursement from the state twice a year — auditors suggested they file for reimbursements once a month instead. A random check of expense reimbursements to employees found a receipt with no details — auditors suggested that all expense reports filed have all the details.

“That’s not a violation of our formal policy, but we do tell our folks to turn details. Occasionally it happens — somebody forgets,” Alligood said. “If we see somebody consistently do that, then we tell them they won’t get reimbursement if they don’t turn in receipts and that solves the problem quickly.”