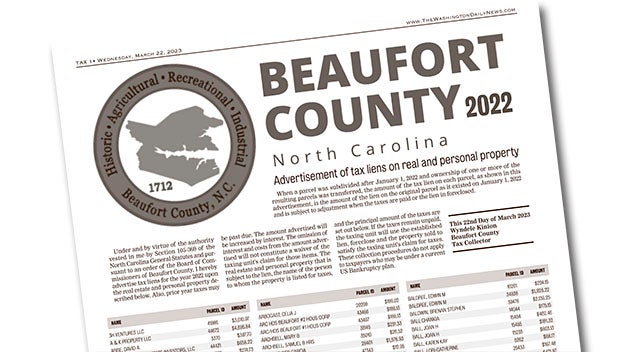

Beaufort County: advertisement of tax liens on real and personal property

Published 8:00 am Wednesday, March 22, 2023

|

Getting your Trinity Audio player ready...

|

Under and by virtue of the authority vested in me by Section 105-369 of the North Carolina General Statutes and pursuant to an order of the Board of Commissioners of Beaufort County, I hereby advertise tax liens for the year 2022 upon the real estate and personal property described below. Also, prior year taxes may be past due. The amount advertised will be increased by interest. The omission of interest and costs from the amount advertised will not constitute a waiver of the taxing unit’s claim for those items. The real estate and personal property that is subject to the lien, the name of the person to whom the property is listed for taxes, and the principal amount of the taxes are set out below. If the taxes remain unpaid, the taxing unit will use the established lien, foreclose and the property sold to satisfy the taxing unit’s claim for taxes. These collection procedures do not apply to taxpayers who may be under a current US Bankruptcy plan.

This 22nd Day of March 2023,

Wyndele Kinion

Beaufort County Tax Collector

When a parcel was subdivided after January 1, 2022 and ownership of one or more of the resulting parcels was transferred, the amount of the tax lien on each parcel, as shown in this advertisement, is the amount of the lien on the original parcel as it existed on January 1, 2022 and is subject to adjustment when the taxes are paid or the lien in foreclosed.

Click the link below to view the Beaufort County advertisement of tax liens on real and personal property:

WDN_Beaufort County tax liens_03.22.2023